Can Myanmar Jade Auctions Predict Retail Prices? Market Realities by Prof. Michelle Au

Introduction

Myanmar’s jadeite auctions have long dictated global jade pricing—but since 2008, speculative capital and shifting buyer demographics have disrupted this relationship. Professor Michelle Au, a world-renowned jade expert, analyzes whether auction results remain reliable benchmarks for collectors and retailers.

1. The Changing Face of Myanmar Auctions

1.1 Pre-2008: Industry-Driven Pricing

- Traditional Buyers: Jade artisans from Guangdong/Yunnan, bidding based on production costs + retail margins.

- Price Stability: Auction prices reflected actual market demand for carvable material.

1.2 Post-2008: The Speculator Era

- New Players: Chinese state-backed enterprises, Myanmar speculators (50% of 2010 bidders), and “hot money” investors.

- Record-Breaking Bids:

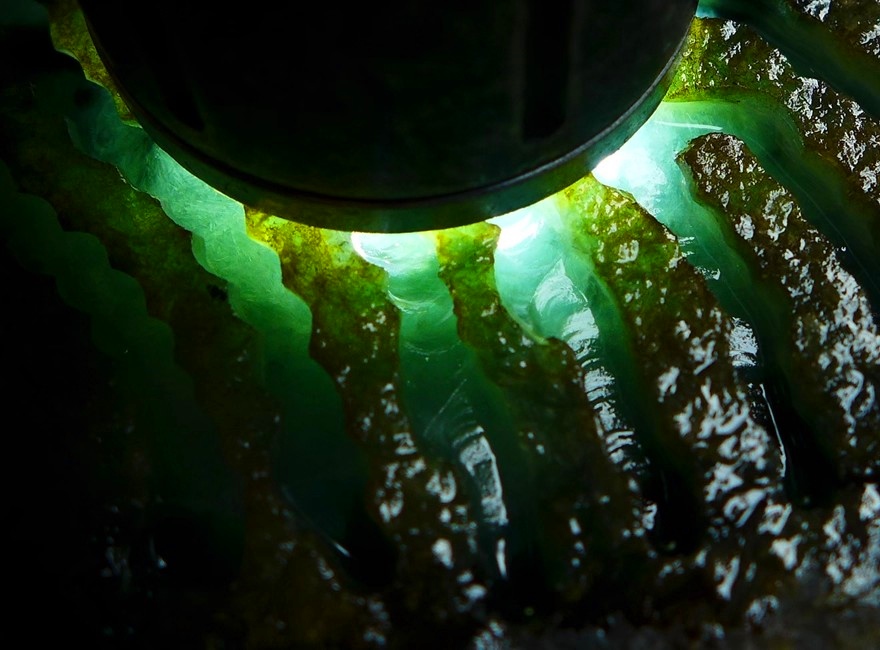

- Case Study: A 6kg violet jadeite rough sold for €19.89M (200x estimate)—bought as an investment asset, not for carving.

- Impact: High-grade rough prices decoupled from retail realities.

2. Auction Outcomes vs. Retail Realities

2.1 The Disconnect

- Bracelet Crisis: While auction prices for top-tier bracelet material surged 100%, mid-grade rose only 30%, and low-grade stagnated.

- Retail Lag: Many merchants couldn’t pass on costs, leaving inventories unsold.

2.2 The “Two-Tier” Market

| Grade | Auction Price Trend | Retail Viability |

|---|---|---|

| High (Glass/Violet) | +100–200% | Elite collectors only |

| Mid (Ice) | +30–50% | Selective buyers |

| Low (Bean) | Flat | Mass-market demand |

3. Strategic Insights for Stakeholders

- Collectors:

- Focus on mid-grade “ice” jadeite—balanced rarity and affordability.

- Verify if sellers’ price hikes match actual auction comps.

- Retailers:

- Diversify with recycled/vintage jade to bypass rough auctions.

- Investors:

- Treat high-end auction spikes as anomalies; track retail liquidity.

Source: Ouyang, Q. (2010). “Can Myanmar Jade Auctions Guide Retail Prices?” China Gems & Jades.

緬甸公盤能否預測翡翠成品價?歐陽秋眉揭市場真相

引言

緬甸翡翠公盤長期主導全球價格,但2008年後投機資本與買家結構的改變,動搖了其指標性。國際權威歐陽秋眉教授解析:拍賣結果是否仍是零售價的可靠風向球?

1. 緬甸公盤的質變

1.1 2008年前:產業主導定價

- 傳統買家:廣東/雲南玉雕師傅,基於加工成本+合理利潤競標。

- 價格穩定:反映市場真實需求。

1.2 2008年後:投機時代

- 新勢力:中國國企、緬甸炒家(2010年佔50%)、熱錢投資客。

- 天價案例:

- 6公斤紫翡原石以1,989萬歐元成交(估價200倍)——被視為投資品而非雕料。

- 衝擊:高端原石價與零售脫鉤。

2. 公盤與零售的落差

2.1 斷層現象

- 手鐲危機:頂級手鐲料公盤價暴漲100%,中檔僅漲30%,低檔滯銷。

- 零售困境:商家無法轉嫁成本,庫存積壓。

2.2 「雙軌制」市場

| 等級 | 公盤漲幅 | 零售接受度 |

|---|---|---|

| 高檔(玻璃/紫羅蘭) | +100–200% | 僅限頂級藏家 |

| 中檔(冰種) | +30–50% | 選擇性買盤 |

| 低檔(豆種) | 持平 | 大眾市場 |

3. 給不同角色的建議

- 藏家:

- 關注中檔冰種——稀缺性與價格平衡。

- 核實商家漲價是否符合公盤同級標的。

- 零售商:

- 開發二手/古董翡翠避開原料波動。

- 投資者:

- 將頂級拍品視為特例,追蹤零售變現力。

資料來源:歐陽秋眉(2010),緬甸原料拍賣會結果能否成為成品價格的風向標,《中國寶石與玉石》。

Read More

Michelle Au: The Gemstone Luminary

- The Symbolic Language of Jadeite: Decoding Auspicious Motifs in Chinese Culture

- Jadeite Texture Types & Their Geological Significance – Prof. Michelle Au’s Structural Analysis

- The Mineral Composition of Jadeite: A Scientific Breakdown by Professor Michelle Au

- Will Jadeite Prices Continue to Rise? – Insights from Professor Michelle Au

- Why Padparadscha Sapphires Lost Their Value: The Heat Treatment Controversy

- Classifying Burmese Jadeite: Mineralogy & Infrared Spectroscopy by Prof. Michelle Au