The 12 Most Valuable Collectibles in 2025: A Collector’s Guide

At VirtuCasa, we present an expert-curated list of investment-worthy collectibles that combine cultural significance with financial potential in the coming year(valuable collectibles 2025).

12. Gold: The Eternal Standard

As the universal symbol of wealth preservation, gold continues its reign:

- 100-year appreciation: ~10,500% (4.8% annual return)

- Central bank reserve asset since ancient times

- Performs inversely to paper currencies during crises

Market Insight: The “antiques in prosperity, gold in turmoil” principle remains relevant as geopolitical tensions influence 2025 markets.

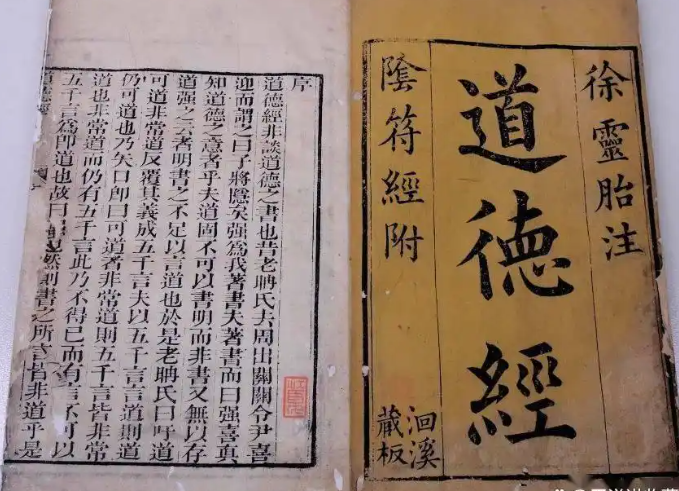

11. Rare Books: Knowledge as Capital

Collectible literature offers dual returns:

- First editions appreciate 8-12% annually

- Medieval manuscripts gain ~15% yearly

- Signed modern classics show sudden value spikes

Pro Tip: Focus on historical Chinese texts like imperial encyclopedias or philosophical treatises with provenance documentation.

10. Folk Handicrafts: Cultural Equity

Traditional craftsmanship gains global recognition:

- Embroidery: Suzhou styles up 200% since 2020

- Woodcarving: Dongyang pieces triple auction estimates

- Bamboo works: Museum-quality pieces scarce

Investment Note: UNESCO heritage-listed techniques command premium valuations.

9. Fine Spirits: Liquid Assets

Chinese alcoholic beverages show remarkable growth:

- Maotai vintage prices increase 25% annually

- 1980s Wuliangye bottles now 180x original value

- Emerging craft distilleries gaining collector interest

Storage Advice: Maintain 15-18°C at 60-70% humidity for optimal aging.

8. Precious Woods: Forest Rarities

Slow-growth timbers become investment-grade:

- Hainan rosewood (Dalbergia odorifera): $3,800/kg

- Golden nanmu: 300-year growth cycles create scarcity

- Agarwood: $100,000/kg for top-grade chips

Ecological Note: Verify CITES certification for legal trade compliance.

7. Archaic Jade: Mineral Wisdom

Neolithic to Han dynasty pieces lead the market:

- Liangzhu culture cong tubes: $4-8 million at auction

- Hongshan culture pendants: 35% annual appreciation

- Imperial white jade seals: Priceless museum pieces

Authentication Tip: Look for burial marks and natural weathering patterns.

6. Organic Gems: Nature’s Rarities

Historical “Three Whites” collection focus:

- Ivory (pre-1947): Legal antique market only

- Rhinoceros horn: $60,000/kg for Ming dynasty items

- Hawksbill turtle shell: Grandfathered pieces appreciating

Ethical Reminder: VirtuCasa only deals in pre-convention documented artifacts.

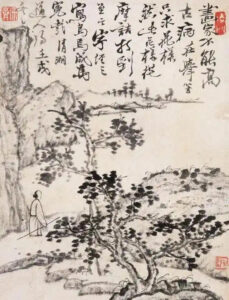

5. Master Paintings: Brushstroke Wealth

Contemporary market trends show:

- Qi Baishi works: $150 million ceiling

- Xu Beihong horses: 22% annual growth

- Living artists: Emerging market potential

Acquisition Strategy: Focus on authenticated works with exhibition history.

4. Antiques: Time Capsules

2025’s most promising categories:

- Ming furniture: 40% price surge since 2020

- Bronze ritual vessels: $12 million auction records

- Scholar’s objects: Inkstones and brush pots in demand

Provenance Tip: Imperial collection marks multiply value 5-10x.

3. Porcelain: China’s Namesake

Market-leading segments:

- Yuan blue-white: $50+ million benchmark

- Ru ware: $30 million for authenticated pieces

- Imperial monochromes: Qing famille-rose gaining

Caution: Over 80% of “antique” porcelain online are replicas.

2. Cultural IP: The New Frontier

Digital traditional culture opportunities:

- Animated classics: Licensing revenue streams

- Restored manuscripts: Digital collectibles

- AR/VR heritage experiences: Museum partnerships

Innovation Example: Blockchain-authenticated digital scroll reproductions.

1. Cash: The Ultimate Flexibility

Why liquidity matters:

- Enables opportunistic acquisitions

- Provides market downturn protection

- Funds proper storage/insurance

Financial Wisdom: Allocate only 10-15% of net worth to collectibles.

VirtuCasa’s Collector Services

We offer:

- Authentication consultations

- Acquisition strategy sessions

- Collection management solutions

- Legacy planning guidance

Begin building your valuable collectibles 2025 with our Investment Guide.

Final Thought: True collecting balances passion with prudence – the wisest investors preserve both cultural heritage and financial stability.