Demystifying Auction Guarantees: How “Irrevocable Bids” Shape the Art Market

The Power of Guarantees in Auction Houses

Auction guarantees have become a cornerstone strategy for major houses like Christie‘s and Sotheby‘s. According to ArtTactic’s 2019 report, guaranteed lots accounted for 22.9% of Christie’s Impressionist & Modern evening sales but generated 34.1% of total revenue—proving their disproportionate impact on premium collections.

擔保機制如何影響拍賣行業績?

擔保拍品已成為佳士得、蘇富比等頂級拍行的核心策略。ArtTactic 2019年報告顯示:儘管擔保拍品僅占佳士得「印象派及現代藝術」夜場的22.9%,卻貢獻了34.1%的總成交額,顯示其對高價品類的槓桿效應。

What Is an Irrevocable Bid?

An auction guarantee is a legally binding agreement where a third party (or the auction house) pledges to purchase a lot if it fails to meet a confidential minimum price (“the hammer price”). This model:

- Protects sellers from market volatility

- Incentivizes consignors to entrust premium pieces

- Shares upside—guarantors earn 30-50% of the excess when lots outperform

什麼是不可撤銷報價?

拍賣擔保是具有法律效力的協議,第三方(或拍賣行)承諾若拍品未達保密底價時將購入該品。這種模式:

- 保護賣家免受市場波動影響

- 吸引藏家委託頂級拍品

- 利潤共享—若成交價超擔保價,擔保方可分得30-50%溢價

Case Studies: Guarantees in Action

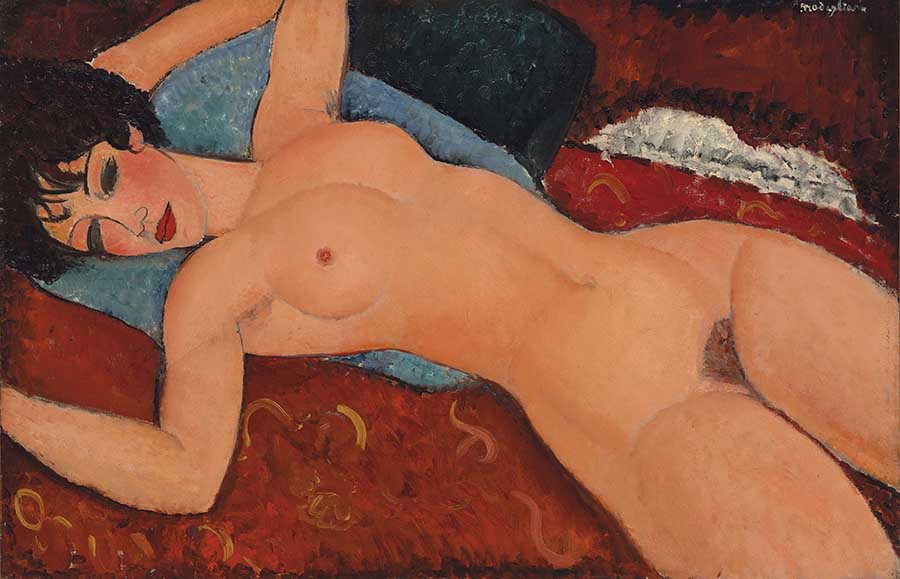

- Modigliani’s Nu Couché (2018)

- $157.2M sale ($150M pre-arranged guarantee)

- Demonstrated how guarantees mitigate risk for ultra-high-value lots

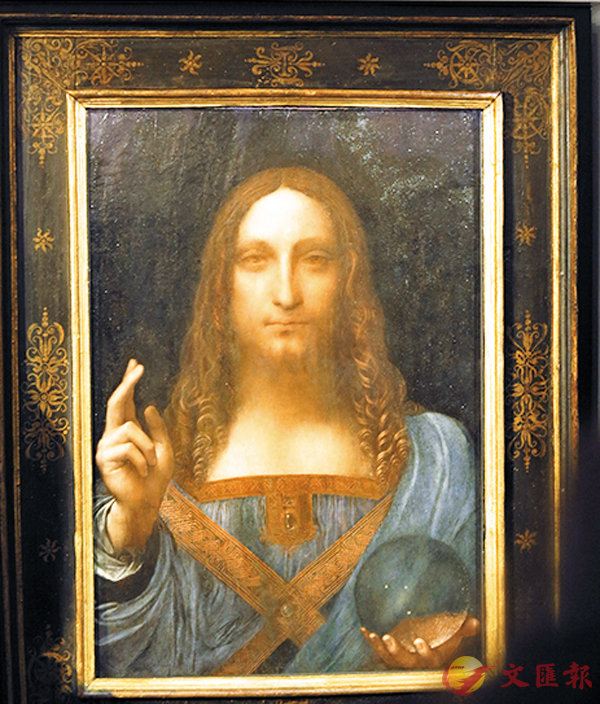

- Da Vinci’s Salvator Mundi (2017)

- $100M guarantee preceded its $450.3M historic sale

- Highlighted the “insurance policy” effect for trophy assets

經典擔保案例

1.莫迪利亞尼《側臥的裸女》(2018)

- 1.572億美元成交(1.5億美元事前擔保)

- 展現擔保機制對天價拍品的風險管控

2.達文西《救世主》(2017)

- 1億美元擔保價,最終以4.503億美元創紀錄

- 印證擔保對「標王級」拍品的托底作用

The Anatomy of a Guarantee Deal

A $100M hypothetical scenario reveals four outcomes:

| Scenario | Outcome for Guarantor |

|---|---|

| No bids | Pays $100M, keeps lot |

| $80M hammer price | Covers $20M shortfall |

| $100M exact | No action required |

| $120M sale | Earns 30-50% of $20M excess |

擔保交易的四种情境

以1億美元擔保價為例:

| 情境 | 擔保方結果 |

|---|---|

| 流拍 | 支付1億美元,獲得拍品 |

| 8000萬美元落槌 | 承擔2000萬美元差額 |

| 剛好1億美元成交 | 無需行動 |

| 1.2億美元成交 | 分得2000萬溢價的30-50% |

Who Are the Guarantors?

Post-2008, auction houses shifted from self-guaranteeing to third-party backers:

- Art Funds: e.g., Fine Art Fund Group’s dedicated guarantee vehicles

- Shadow Collectors: Ultra-HNWIs seeking pre-sale access

- Financial Institutions: Specialty lenders like Athena Art Finance

誰在扮演擔保方?

2008年後,拍賣行轉向第三方擔保:

- 藝術基金:如英國美術基金的擔保專項

- 隱形藏家:超高淨值人士透過擔保獲優先權

- 金融機構:如Athena Art Finance等藝術信貸公司

Why This Matters for Asian Collectors

While Western markets have mature guarantee ecosystems, Asia’s art finance infrastructure is still developing. At VirtuCasa, we’re pioneering blockchain-based smart contracts to:

- Tokenize guarantee agreements

- Automate profit-sharing via $VTC tokens

- Provide transparent price discovery

對亞洲藏家的啟示

相較歐美成熟的擔保體系,亞洲藝術金融仍在發展。VirtuCasa正研發基於區塊鏈的智能合約:

- 將擔保協議代幣化

- 透過$VTC代幣自動分配收益

- 建立透明價格發現機制

Key Takeaways

- Guarantees de-risk consignments of trophy assets

- Third parties now dominate guarantee markets

- Asia’s art market needs localized solutions

核心結論

- 擔保機制降低「標王級」拍品委託風險

- 第三方機構已成擔保市場主力

- 亞洲需發展本土化藝術金融方案

Read More

- The Refined Gentleman: Balancing Nature and Nurture in Hetian Jade AppreciationExplore the Confucian philosophy of “文质彬彬” (Wen Zhi Bin Bin) as a lens for Hetian jade appreciation. Discover how the balance of natural substance and carved decoration defines a masterpiece. A guide for collectors on virtucasa.com.

- The Million-Dollar Carving: When Hetian Jade Craftsmanship Surpasses the Material ItselfDiscover the pinnacle of Hetian jade carving:openwork,inked chains, and ultra-thin vessels. Explore why the craftsmanship can cost more than the jade itself. A guide for collectors on virtucasa.com.

- The Eternal Craft: A Journey Through 7,000 Years of Chinese Ivory CarvingDiscover the 7,000-year legacy of Chinese ivory carving, a UNESCO Intangible Cultural Heritage. Explore its imperial history, regional schools, masterpieces, and future under conservation. A guide for collectors on virtucasa.com.

- Auspicious Adornments: The Complete Guide to Lunar New Year JewelryDiscover the best jewelry for Lunar New Year: jadeite, gold, silver & gemstones. Learn auspicious meanings, wearing traditions & tips for choosing meaningful gifts on Virtucasa.com.

- Auspicious Adornments: The Best Jadeite Jewelry to Wear for Lunar New YearDiscover the best jadeite jewelry for Lunar New Year. Explore auspicious motifs like Ruyi & Pixiu, wearing traditions, and tips for choosing meaningful jadeite gifts on Virtucasa.com.