The Global Jadeite Market: Cultural Forces & Future Trends

Introduction

Jadeite’s value transcends mere aesthetics—it’s a cultural barometer. In this analysis, Professor Michelle Au and Yan Jun decode how Confucian traditions, Western gemology, and generational shifts shape demand across continents. For collectors and investors, understanding these dynamics is key to navigating the jadeite market’s complexities.

1. Cultural Foundations of Jadeite Demand

1.1 The Three Cultural Spheres

- Western Markets:

- Preferences: Faceted gems (e.g., diamonds, sapphires); value transparency over symbolism.

- Jadeite Perception: Viewed as opaque “ornamental stone” unless haute joaillerie pieces.

- Islamic Markets:

- Taboos: Animal motifs forbidden; favor turquoise/emeralds.

- Opportunity: Untapped potential for geometric jadeite designs.

- Confucian Markets (China/SE Asia):

- Symbolism: Jade = moral integrity (“君子比德於玉”).

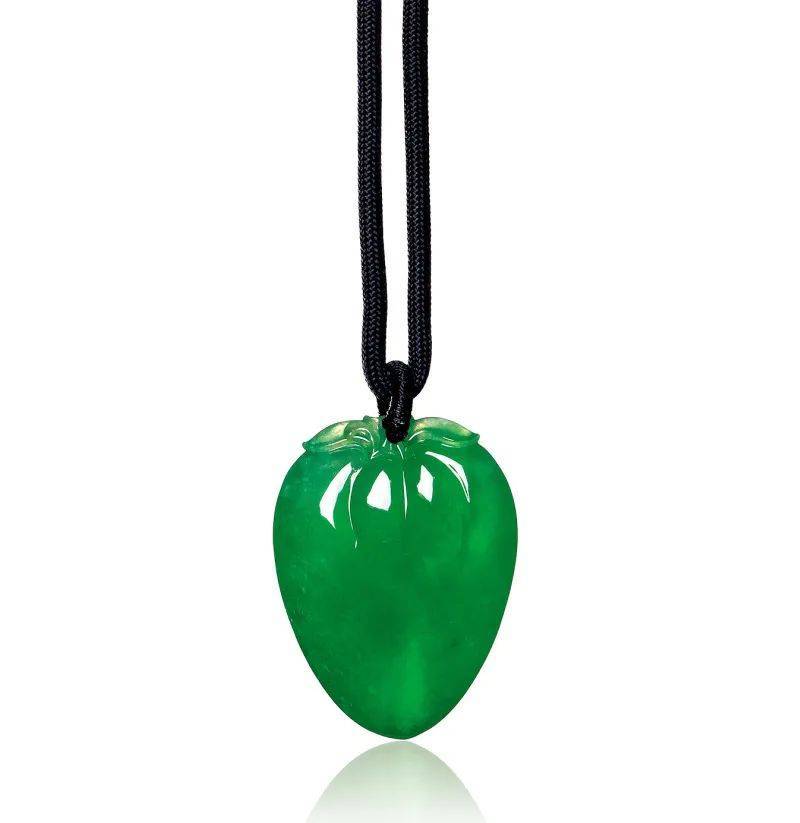

- Top Sellers: Bangle bracelets (health/luck), Buddha pendants.

1.2 Design Implications

- Traditional: Carved dragons/phoenixes dominate Chinese auctions.

- Modern: Minimalist jadeite solitaires gaining traction in Milan/NYC.

2. Regional Market Snapshots

2.1 The Americas

- US Elite: Seek “Imperial Green” jadeite at Christie’s ($1M+ necklaces).

- Mainstream: Big-box retailers sell dyed jadeite (B/C货) as fashion accessories.

- Diaspora Effect: 1st-gen Chinese immigrants drive heirloom demand.

2.2 Southeast Asia

- Malaysia: “Poh Chuan” (apple-green jadeite) favored by young professionals.

- Indonesia: B/C货 scandals eroded trust; education campaigns underway.

2.3 Japan’s Paradox

- Heritage: Jadeite magatama beads in Shinto rituals.

- Modern Trends: Reject B货; favor 20% premium for “Japanese-cut” cabochons.

2.4 China’s Meteoric Rise

- 1990s: State-controlled jadeite exports only.

- 2020s: Domestic auction records (e.g., HK$70M necklace in 2022).

- Challenges: Flooded with synthetic moissanite mislabeled as “ice jade.”

3. Future-Proofing the Market

3.1 Urgent Reforms

- Certification: Mandate Gübelin/NGTC reports for >$10k pieces.

- Design Innovation: Collaborate with Western jewellers (e.g., Cartier’s 2023 jadeite collection).

- Youth Outreach: TikTok campaigns demystifying jadeite grading.

3.2 Investment Outlook

- Safe Bets: Mid-tier “ice” jadeite (平衡稀缺性与流通性).

- Risky: Ultra-high-end pieces dependent on Chinese economic stability.

How do you see global jadeite market trends evolving in the coming years?

Source: Ouyang, Q. & Yan, J. (2003). “Perspectives on Jadeite Market Development.” Journal of Gems and Gemmology, 38–39.

翡翠市場全景分析:文化驅動力與未來趨勢

引言

翡翠的價值超越美學,更是文化的溫度計。歐陽秋眉教授與嚴軍解析儒家傳統、西方寶石學與世代差異如何塑造全球需求。

1. 需求的文化根基

1.1 三大文化圈

- 西方市場:

- 偏愛刻面寶石(如鑽石);重視透明度勝過寓意。

- 翡翠多被視為「裝飾性石材」。

- 伊斯蘭市場:

- 禁忌:動物造型;偏好綠松石/祖母綠。

- 機會:幾何設計翡翠的潛力。

- 儒家文化圈(中/港/台/東南亞):

- 象徵:玉喻品德(「君子比德於玉」)。

- 熱銷款:手鐲(健康/運勢)、佛像吊墜。

1.2 設計啟示

- 傳統:龍鳳雕刻主導華人拍賣會。

- 現代:極簡翡翠單石設計在米蘭/紐約崛起。

2. 區域市場快照

2.1 美洲

- 美國精英:在佳士得競投「帝王綠」翡翠(百萬美元項鍊)。

- 大眾市場:連鎖店銷售染色翡翠(B/C貨)作為時尚配件。

- 僑民效應:第一代移民傳承需求強勁。

2.2 東南亞

- 馬來西亞:年輕職人鍾愛「坡裝」蘋果綠翡翠。

- 印尼:B/C貨醜聞衝擊信任;教育計畫進行中。

2.3 日本的矛盾

- 傳統:神道儀式中的勾玉。

- 現代:拒收B貨;願為「日式切割」蛋面支付20%溢價。

2.4 中國的爆發式成長

- 90年代:翡翠僅限國營出口。

- 2020年代:國內拍賣紀錄(如2022年7,000萬港幣項鍊)。

- 隱憂:合成莫桑石冒充「冰種翡翠」氾濫。

3. 市場未來化

3.1 關鍵改革

- 證書制度:萬元以上翡翠需附Gübelin/NGTC報告。

- 設計創新:與西方品牌合作(如卡地亞2023翡翠系列)。

- 年輕化:透過TikTok普及分級知識。

3.2 投資展望

- 穩健選擇:中檔冰種翡翠(稀缺性與流通性平衡)。

- 高風險:頂級藏品依賴中國經濟穩定性。

資料來源:歐陽秋眉、嚴軍(2003),全方位看翡翠市場的發展,《寶石和寶石學雜誌》,38–39。

Read More

Michelle Au: The Gemstone Luminary

- The Symbolic Language of Jadeite: Decoding Auspicious Motifs in Chinese Culture

- Jadeite Texture Types & Their Geological Significance – Prof. Michelle Au’s Structural Analysis

- The Mineral Composition of Jadeite: A Scientific Breakdown by Professor Michelle Au

- Will Jadeite Prices Continue to Rise? – Insights from Professor Michelle Au

- Why Padparadscha Sapphires Lost Their Value: The Heat Treatment Controversy

- Classifying Burmese Jadeite: Mineralogy & Infrared Spectroscopy by Prof. Michelle Au

- Can Myanmar Jade Auctions Predict Retail Prices? Market Realities by Prof. Michelle Au

- The Science of “Inky Black Jade”: Omphacite Jade Explained by Prof. Michelle Au