Will Jadeite Prices Continue to Rise? – Insights from Professor Michelle Au

Introduction

Jadeite, a gemstone deeply rooted in Chinese culture, has seen dramatic price fluctuations over the past two decades. Professor Michelle Au (歐陽秋眉), a world-renowned gemologist and founder of the Hong Kong Gemmological Institute, provides an in-depth analysis of the factors driving jadeite’s market trends. This article explores her perspectives on supply, demand, and the future of jadeite pricing.

The Surging Demand for Jadeite in China

Since 2006, China’s jadeite market has experienced exponential growth. Several key factors contribute to this trend:

- Expanding Consumer Base

- Middle-Class Buyers: Affordable jadeite (priced between a few thousand to hundreds of thousands of RMB) remains popular among average consumers due to cultural affinity.

- High-Net-Worth Collectors: Wealthy individuals, particularly from industries like real estate and mining, invest in premium jadeite (priced above ¥500,000) as a store of value.

- Gift Culture: Jadeite’s auspicious symbolism makes it a preferred luxury gift in business and social exchanges.

- Market Speculation & Investment

- External capital from non-traditional investors (e.g., real estate, finance) has flooded the jadeite rough-stone market, driving prices to unprecedented levels.

Supply Constraints: The Burmese Jadeite Crisis

Myanmar, the sole source of gem-grade jadeite, faces severe depletion:

- Resource Exhaustion: Decades of aggressive mining have depleted high-quality deposits. As Professor Au notes, “It takes 10,000 stones to yield one piece of jade; 10,000 jades to yield one emerald-green gem.”

- Rising Costs: Extraction expenses (e.g., fuel, labor) soar while yields decline. Many mines operate at a loss.

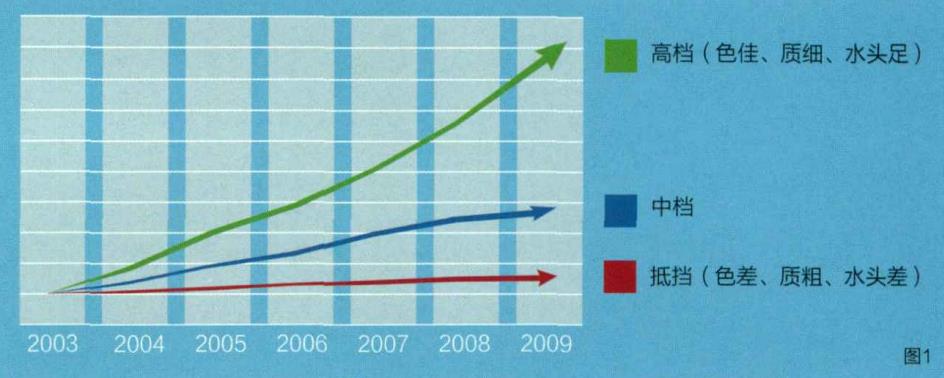

- Market Polarization:

- High-grade jadeite (vibrant color, fine texture, minimal flaws) has surged 10x in price over six years due to scarcity.

- Low-grade jadeite (“brick material”) stagnates in value.

Future Outlook: A Divided Market

Professor Au’s analysis reveals a clear divergence:

- High-End Jadeite: Prices will continue rising due to irreversible scarcity and elite demand.

- Mid-Range Jadeite: Steady appreciation expected.

- Low-End Jadeite: Minimal growth; susceptible to market saturation.

Key Takeaways

- Investors: Focus on high-quality jadeite with provenance.

- Collectors: Understand the 4C2T1V standard (Color, Clarity, Cut, Carat, Texture, Transparency, and Value) to assess true worth.

- Consumers: Rising prices may exclude entry-level buyers; consider pre-owned or alternative gemstones.

From China Academic Journal Electronic Publishing House.

翡翠的價格會持續攀升嗎?——歐陽秋眉教授深度解析

引言

翡翠,這種深植於華人文化的寶石,過去二十年價格經歷了劇烈波動。香港珠寶學院創辦人、國際著名寶石學家歐陽秋眉教授從供需關係切入,解析翡翠市場的現狀與未來。

中國市場:翡翠需求暴漲的推力

自2006年起,中國翡翠市場持續升溫,關鍵因素包括:

- 消費群體擴張

- 中產階級:價格親民(數千至數十萬人民幣)的翡翠因文化偏好而熱銷。

- 高淨值藏家:房地產、礦業等行業的富豪將高檔翡翠(50萬人民幣以上)視為保值資產。

- 禮品文化:翡翠的吉祥寓意使其成為高端送禮首選。

- 投機性資本涌入

- 來自房地產、金融等行業的外部資金炒作原石,加劇價格泡沫。

供應危機:緬甸翡翠的枯竭困境

緬甸作為寶石級翡翠的唯一產地,面臨資源枯竭:

- 開採殆盡:歐陽教授指出,「萬石養一玉,萬玉養一翠」,高檔翡翠形成條件苛刻,次生礦終將耗盡。

- 成本飆升:燃料、人工費用上漲,許多礦場血本無歸。

- 市場兩極化:

- 高檔翡翠(色佳、種細、瑕疵少)六年內價格暴漲十倍。

- 低檔磚頭料價格停滯。

未來趨勢:分化加劇

歐陽教授的供需模型顯示:

- 高檔翡翠:稀缺性不可逆,價格長期看漲。

- 中檔翡翠:穩步升值。

- 低檔翡翠:升值空間有限。

實用建議

- 投資者:聚焦具證書的高品質翡翠。

- 藏家:運用4C2T1V標準(顏色、淨度、切工、克拉、質地、透明度、價值)評估真偽。

- 普通消費者:價格門檻升高,可考慮二手市場或替代寶石。

Read More