Art Consumption and Art Finance: A Comprehensive Analysis

解析藝術消費與藝術品金融

With economic development and rising incomes, the integration of art into daily life has become increasingly common. Fine art is now widely recognized as an important component of wealth management.

伴隨著經濟發展和收入提升,藝術生活化、生活藝術化越來越普遍,藝術精品作為財富管理的重要組成部分已經深入人心(Art consumption & art finance trends)。

Professor Huang Jun, Associate Dean of the School of Applied Economics and Deputy Director of the China Institute of Art Finance at Renmin University of China, recently published the monograph Art Market: Consumption and Finance through China Financial Publishing House. This work examines the art market from a financial perspective, exploring financial services such as art consumption and investment from the demand side. In an interview with Financial Times, Professor Huang discussed her latest research and current trends in the art market.

中國人民大學應用經濟學院副院長、中國藝術品金融研究所副所長黃雋教授的專著《藝術品市場:消費與金融》近日由中國金融出版社出版。該書從金融學視角觀察藝術品市場,從藝術品市場需求角度研究藝術品消費和收藏投資等金融服務。日前,《金融時報》記者就該書的新研究成果以及藝術品市場狀況採訪了黃雋。

Contemporary Art Consumption

當代的藝術品消費

FT Reporter: Art consumption is a key part of your new book. How do you view art consumption?

《金融時報》記者:藝術品消費是您新書的重要部分。您如何看待藝術品消費?

Huang Jun: In contemporary China, consumption exhibits diversity and multi-layered characteristics. Art Market: Consumption and Finance examines topics such as consumption upgrading metrics, art education, the integration of design into work and life, and art market supply and demand.

黃雋: 當代中國,消費呈現多元化和多層化態勢。《藝術品市場:消費與金融》對消費升級的特徵與度量、美育教育、設計走進工作和生活、藝術品市場供給與需求等進行了研究。

As China’s economy grows and wealth accumulates, public demand for spiritual culture and quality of life intensifies. In recent years, the number of museums, galleries, exhibitions, and visitors has significantly increased. The meaning of art consumption has evolved from merely purchasing artworks to integrating art into life and environment.

伴隨著中國經濟發展與財富積累,百姓對精神文化和美好生活的需求越來越強烈。最近幾年,我國的博物館、美術館、展覽活動和觀展人次的數量均明顯提升。藝術品消費的含義已經從單純的購買藝術品轉變為讓藝術成為生活和環境的一部分。

Industries increasingly demand art and design. Deep integration of art with related sectors—rural revitalization, real estate, technology, tourism, retail, and home furnishing—demonstrates derivative development. Many galleries have successfully shaped the design style and artistic character of surrounding areas, using public art to rejuvenate urban spaces.

產業對藝術和設計的需求日趨明顯,藝術品與相關產業深度融合,藝術走進鄉村、地產、科技、旅遊、商場、家居等方面衍生發展。不少美術館的建立成功塑造了周邊區域的設計風格與藝術氣質,公共藝術使都市再生。

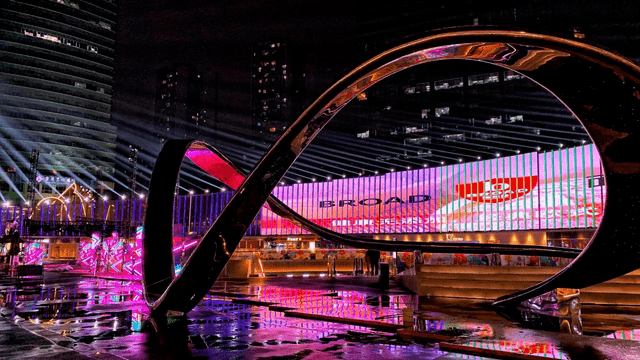

“Without foot traffic, there is no cash flow.” Many industries collaborate with art and design to create social media hotspots, attracting and retaining young people while enhancing commercial uniqueness. Examples include Beijing Jinbao Place’s 202Q Art Festival and Chongqing Liangjiang New Area’s “THE OVAL” commercial complex, developed with renowned domestic and international artists.

沒有人流就沒有現金流,不少產業通過與藝術和設計聯姻,打造網紅打卡地,吸引和留住年輕人,提升商業獨特性和吸引力。例如,北京金寶匯購物中心推出202Q藝術節,重慶兩江新區聯動國內外知名藝術家打造藝術空間的「THE OVAL 一奧天地」商業綜合體開業等都是很好的例證。

It is important to recognize that art consumption is non-essential—it is more elastic relative to basic needs and fluctuates with macroeconomic conditions. Beyond income and wealth, art consumption relates to art education and lifestyle habits, which require cultivation over time.

我們需要清醒地認識到,藝術品消費不是剛性需求,它相較於基本生活需求,隨宏觀環境變化的彈性較大。藝術品消費除了與收入財富有關外,還與美育教育、生活方式等習慣性因素有關,而這些養成需要素質培養和時間積澱。

Challenges in Art Finance

直面藝術品金融的難點

FT Reporter: Fine art inherently possesses financial attributes. How do you view the art finance market?

《金融時報》記者:藝術精品本身就具有金融屬性。您如何看待藝術品金融市場?

Huang Jun: Over the past two decades, China’s art finance market has become one of the world’s most active, with numerous innovations and explorations. As spiritual products, high-quality artworks resemble technology products in their potential for price appreciation far exceeding traditional assets.

黃雋: 最近20年,伴隨著中國藝術品市場發展,中國藝術品金融市場成為全球最為活躍的市場,出現了不少創新和探索。藝術品作為精神產品,優質的藝術品有些像科技產品,價格上漲的想像空間遠大於傳統產品。

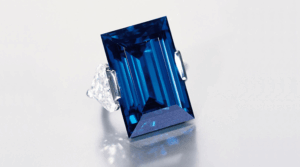

The direct perception of art finance is significant price increases generating substantial investment returns. Globally, wealth management services like art acquisition, family trusts, and bonded art storage primarily serve high-net-worth collectors or institutions. This book examines the financial attributes of art assets, art consumption finance, art collection and investment, art financing, and family trusts.

人們對藝術品金融的直接感受是藝術品價格的明顯上漲而帶來了可觀的投資收益。從全球來看,藝術品藏購、家族信託、藝術品保稅等財富管理服務主要服務面向高淨值藏家或者相關機構。本書對藝術品資產的金融屬性、藝術品消費金融、藝術品收藏與投資、藝術品融資、家族信託等方面進行了研究。

In December 2010, the “Notice on Supporting Cultural Industry Development with Insurance” identified comprehensive art insurance as a pilot category. However, after ten years, art insurance remains exploratory. High-value artworks deter clients with expensive premiums, leading them to prefer enhanced security measures instead. Additionally, China lacks authoritative art appraisal and valuation institutions.

2010年12月,《關於保險業支持文化產業發展有關工作的通知》發布,將藝術品綜合保險確定為試點險種。然而,10年過去了,藝術品保險一直處於試水和探索狀態。原因在於不少藝術精品價值高,客戶對高額保費望而卻步,寧願自己加強安保和防護,而且國內缺乏具有公信力的藝術品鑑定估值機構。

While domestic and international exhibitions grow significantly, art insurance represents a vast blue-ocean market. However, compared to the rapidly developing art market, art insurance requires specialized knowledge, and insurers lack motivation, resulting in limited scale. Huge demand contrasts with weak supply, leaving many artworks “uninsured.”

每年國內外的展覽呈明顯增長態勢,藝術品保險是一個廣闊的藍海市場,但是與快速發展的藝術品市場相比,藝術品保險專業性較強,保險公司動力不足,藝術品保險的規模非常有限。巨大的需求市場對應著非常疲弱的供給,很多藝術品都處於「裸奔」狀態。

Thus, authentication, valuation, and liquidity are the main challenges in integrating art with finance. In 2020, China’s GDP exceeded 100 trillion yuan, with spiritual needs becoming integral to consumption upgrading and quality of life. Art education and art consumption are increasingly embraced.

由此看來,藝術品的鑑定、估值和流動性是藝術品與金融結合的難點。2020年我國GDP邁上百萬億元大台階,精神需求已經成為人們消費升級和美好生活的重要組成部分,美育教育與藝術消費越來越深入人心。

Technology holds potential for transformation. Increasing information transparency, coupled with improved social credit environments, can address art-finance integration challenges, enabling innovation in art consumption and finance.

科技蘊藏著變革和機會。借助科技發展,信息越來越透明。同時社會治理使信用環境進一步提升,解決藝術品與金融對接的難點,可使藝術品消費和藝術品金融有更多的創新和拓展(Art consumption & art finance trends)。

Evolution of the Art Market

藝術品市場的變化

FT Reporter: Five years ago, you published Art Finance: From Micro to Macro. What changes have you observed in the art market over the past five years?

《金融時報》記者:5年前您出版了專著《藝術品金融——從微觀到宏觀》,在您看來,最近5年的藝術品市場有哪些變化?

Huang Jun: With economic slowdown, the pro-cyclical art market has inevitably returned to rationality and normalization. Over the past five years, market and policy changes—Brexit, the global COVID-19 pandemic, and other sudden events—have brought volatility and uncertainty. Innovation and adaptation have become central themes.

黃雋: 伴隨著經濟增速放緩,作為順周期的藝術品市場也不可避免地回歸理性和常態。回顧過去5年市場、政策的變化,國內外宏觀環境的劇烈變化和各種事件的突如其來,英國脫歐、新冠疫情全球蔓延等事件應接不暇。藝術品市場無法獨善其身,全球政治經濟環境的變化給藝術品市場帶來了很大的波動性和不確定性,藝術品市場創新求變成為主旋律。

First, market integration is trending. China promotes convenient domestic and international art transactions through bonded art zones in Shanghai, Beijing, Xiamen, Kaifeng, etc. In 2018, the world’s largest bonded art warehouse opened in Shanghai’s Waigaoqiao Pilot Free Trade Zone, which has excelled in efficient services for customs clearance, exhibitions, and foreign exchange transactions. Many globally renowned art institutions are now clients.

首先,市場融合發展成為趨勢。 一是我國大力推動國內外藝術市場交易便利和相融,推出了上海、北京、廈門、開封等多個藝術品保稅區。2018年,全球最大藝術品保稅倉庫在上海浦東外高橋投入使用,上海自貿區不斷進行制度創新,在藝術品的通關展示、外匯交易等提供高效服務方面可圈可點。全球不少知名藝術品機構成為上海自貿區的客戶。

The traditional boundary between galleries (primary market) and auction houses (secondary market) is blurring, with both entering each other’s domains to compete for resources. Examples include “Sotheby’s Gallery Network” and the Marlborough family’s decision to consign classic collections to top galleries (Gagosian, Acquavella, Pace) rather than Sotheby’s or Christie’s.

二是畫廊與拍賣行一二級市場之間傳統的邊界越來越模糊,雙方互進對方領域爭奪優質資源,市場在競爭中融合。例如,「蘇富比畫廊網絡」的出現,美國知名藝術品收藏家馬龍家族將經典收藏品的出售權意外地沒有委託給蘇富比和佳士得,而是委託給了高古軒、阿奎維拉和佩斯3家頂級畫廊。這些新動向都指向這一特徵。

Second, auction markets are polarizing. After two decades of fluctuations, speculative capital has mostly withdrawn, and the market has rationalized. Auction scale has declined. Fine art, due to historical-cultural value and scarcity, remains sought-after, with items exceeding 100 million yuan not uncommon. However, ordinary artworks attract little interest. Only fine art preserves value, appreciates, and functions in asset allocation; most ordinary pieces yield no returns.

其次,拍賣市場兩極分化。 中國藝術品市場經過近20年的波瀾起伏,投機資金大多撤離,最近幾年市場回歸理性,中國藝術品拍賣市場規模下降。藝術精品由於其歷史文化價值和稀缺性,仍然被追捧,上億元的拍品並不少見,但普通藝術品則無人問津。只有藝術精品才具有保值增值與資產配置效應,而絕大多數普品投資沒有回報。

Auction houses generally adopt strategies of “reducing quantity, improving quality,” combining artworks from different eras and styles to attract more collectors. Meanwhile, generational shifts in collectors bring aesthetic changes—younger buyers with broader knowledge and perspectives increase, and “street art” and “trendy art” favored by youth begin influencing the market.

順應市場變化,拍賣行普遍採取了減量增質、去粗取精的策略,還嘗試將不同年代、不同風格的藝術品多類別組合拍賣,以激發更多的藏家參與。與此同時,藏家群體迭代引起的審美和品位轉變,知識、視野與觀念更加開闊的年輕買家數量增多,年輕人喜愛的「街頭藝術」「潮流藝術」開始引導著市場的變化。

Third, art fair regional structures are evolving. With central and local governments emphasizing cultural industries, emerging art fairs in economically developed cities like “Art Chengdu” and “Art Xiamen” compete.

再次,藝術品博覽會市場區域結構發生變化。 伴隨著中央政府和各地政府對文化產業的重視,「藝術成都」「藝術廈門」等經濟發達城市的後起之秀藝博會形成相互競爭態勢。

Shanghai’s art fairs have stood out recently. Each November, coinciding with the China International Import Expo, ART021, West Bund Art & Design, and others collaborate with Xuhui Riverside Art District and city art centers, creating vibrant exhibitions and events. The approximately 10-kilometer waterfront space from Rihui Port Bridge to Runway Park offers rich art routes, aligning with Shanghai’s dynamic, fashionable, open, and modern character.

最近幾年,上海藝術博覽會亮眼。每年11月前後,與中國國際進口博覽會相呼應,ART021、上海西岸藝術與設計等藝術博覽會與徐匯濱江藝術區和城市各藝術中心、美術館攜手,「西岸標誌,全城聯動」開展精彩紛呈的展覽和活動,從日暉港橋至跑道公園的約10公里濱水西岸空間沿線豐富的藝術打卡路線,與上海的活力、時尚、開放、現代氣質相契合。

Shanghai’s art fairs target distinct consumer segments, reflecting market specialization and brand effects. Sales are the decisive factor for galleries’ sustained participation. Shanghai focuses on this key transaction element, enhancing quality and efficiency. Despite the global COVID-19 pandemic in 2020, Shanghai International Artwork Trade Month excelled in visitor engagement and transaction scale, becoming a global focus. Shanghai is now a major contemporary art fair hub.

上海藝博會特色鮮明,針對不同的消費群體,藝術市場開始細分,品牌效應開始顯現。參加藝博會的畫廊能夠持續跟進並保持熱度的決定因素是銷售,上海緊緊抓住藝術博覽會交易這個關鍵因素,提質增效。2020年在全球新冠肺炎疫情蔓延的情況下,上海國際藝術品交易月獨領風騷,無論是觀展熱度還是成交規模,都成為全球藝術品市場矚目的焦點。上海已經成為全球重要的當代藝術博覽會中心。

Finally, the art industry rapidly entered the “cloud era.” The 2020 pandemic severely impacted the art sector, closing physical venues and increasing operational pressures. Art institutions embraced digital transformation, offering online exhibitions, education, sales, and live streaming with artists and experts. Technology enables comprehensive, multi-dimensional services, with online channels becoming crucial for customer acquisition and sales. Big data helps track client preferences for precision marketing. While overall auction scale declined in 2020, online auction transactions grew significantly.

同時,藝術品行業快速進入「雲時代」。 2020年的新冠肺炎疫情蔓延對藝術行業造成很大衝擊,線下門店紛紛關停,藝術機構成本和生存壓力凸顯。在技術的支撐下,順應形勢變化,國內外各藝術機構積極應對變革,積極擁抱數字經濟,網上展示、線上美育、銷售、藝術家和藝術品專家等直播帶貨等各種形式層出不窮,採用高技術手段提供全方位、多維度、多層次的服務,線上已經成為各藝術品公司獲客和銷售的重要渠道。藝術機構利用大數據跟踪分析客戶偏好和習慣,精準營銷。科技創新拓展了藝術品行業的廣度和深度。雖然2020年總體拍賣規模明顯下降,但是網上拍賣交易規模大幅提升(Art consumption & art finance trends)。

From 解析艺术消费与艺术品金融

Read More

- The Refined Gentleman: Balancing Nature and Nurture in Hetian Jade Appreciation

- The Million-Dollar Carving: When Hetian Jade Craftsmanship Surpasses the Material Itself

- The Eternal Craft: A Journey Through 7,000 Years of Chinese Ivory Carving

- Auspicious Adornments: The Complete Guide to Lunar New Year Jewelry

- Auspicious Adornments: The Best Jadeite Jewelry to Wear for Lunar New Year